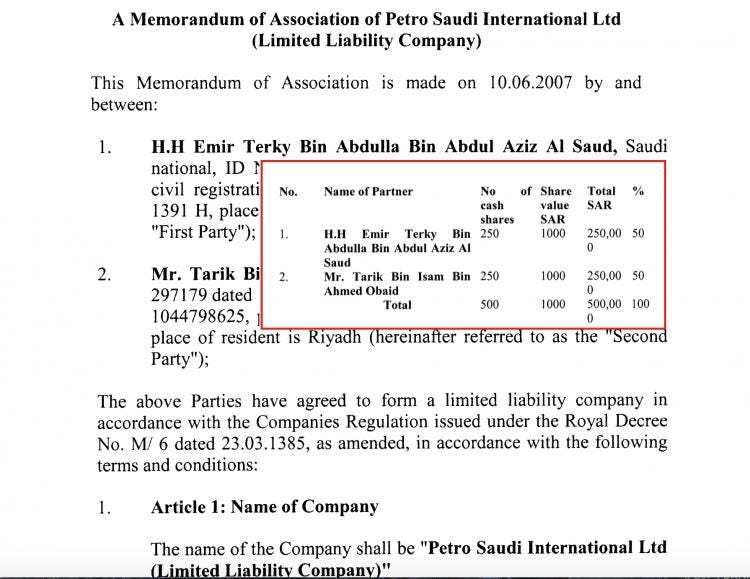

PetroSaudi International is founded and owned by Prince Turki bin Abdullah Al Saud - the 7th son of the then King of Saudi Arabia.

Here is proof of ownership as confirmed by Sarawak Report itself.

|

| Owned by the Prince., Initial paid-up was USD500,000 - which is actually more than 1MDB's fully paid-up capital of RM1 million. |

|

| Excerpt from Sarawak Report's article dismissing Prince Turki of being just "one of dozens of children: |

He is not a so-called "minor" prince among dozens - as alleged by Sarawak Report. By all accounts, he was a favoured son of the King and was made Deputy Governor and eventually, the Governor of the Riyadh province - the second largest province in terms of both area and population. Its capital is the city of Riyadh, which is also the capital of Saudi Arabia.

Not only did the King make Prince Turki the Governor of the capital city but he was also made a Cabinet minister of the Saudi Arabia government.

|

| Future Governor of the Province and Capital City of Riyadh and favoured son of the absolute King of the oil-rich Saudi Arabia wants to steal USD1 billion from another country? Please.... |

No "minor son" or unimportant person would be made Governor of the region with their country's capital city.

The Joint-venture between 1MDB and PetroSaudi was initiated within a short time after a July 2009 meeting between Saudi Arabia's King Abdullah, Prince Turki and Prime Minister Najib Razak.

Prince Turki bin Abdullah Al Saud (born 21 October 1971) is a member of the House of Saud and the seventh son of late King Abdullah, the ruler of Saudi Arabia then. He served as deputy governor of Riyadh Province from 2013 to 2014 and as governor of Riyadh Province from 14 May 2014 to 29 January 2015.

PM Najib was introduced to Prince Turki by the late King Abdullah and told by the late King to work with his son's company when Najib went on a four-day official visit to King Abdullah in July 2009 - one month BEFORE these pictures of Najib with Prince Turki on the boat ride were taken.

In this meeting, King Abdullah Abdulaziz Al Saud had expressed the possibility of Saudi Arabia participating actively in Malaysia in the Islamic banking sector, expanding participation in the Islamic services and product manufacturing sectors and also raising its equity in the country.

| |

|

Shortly after meeting with PM Najib on the boat, Prince Turki then wrote officially on his Royal letterhead to PM Najib to proceed further with the joint-collaboration between Saudi Arabia and Malaysia, in the form of PetroSaudi and 1MDB.

|

| Prince Turki letter to Najib after the meeting |

Prince Turki's letter enclosed PetroSaudi's CEO letter addressed to PM Najib too - which specifically mentioned the meeting between Prince Turki, King Abdullah and Najib.

PetroSaudi has the full backing of the Saudi Arabia government, as can be seen in this 2010 letter from their embassy which states that this Joint-venture will improve the relationship between both countries.

Petrosaudi's own bank, Banque Saudi Fransi also testify to the ownership of PetroSaudi and their financial strength.

Banque Saudi Fransi (BSF) (Arabic: البنك السعودي الفرنسي) is a Saudi Joint Stock Company established by Saudi Arabia Royal Decree No. M/23 dated June 4, 1977.

|

| Saudi Govt owned bank confirming Prince Turki and Tarek are owners of PetroSaudi and confirming their financial strength. |

And just 5 months after this boat trip and photos, on January 17th 2010, PM Najib made another 4-days official trip to Saudi Arabia where he was conferred Saudi Arabia's highest honor, the King Abdulaziz Order of Merit (1st Class) by King Abdullah Abdulaziz Al-Saud.

“I consider this a manifestation of the close relations enjoyed between Saudi Arabia and Malaysia, and it symbolises a huge potential for us to cooperate in various fields, not only in the common interest of the two countries but also for the benefit of the larger Muslim community,” said Najib then

PM Najib did the right things as he was asked by King Abdullah to do business with his Prince's company as part of Saudi Arabia-Malaysia collaboration which is supported by the Royal Saudi embassy and 1MDB got back all their money and made a decent profit - above their cost of funds.

It would be quite ridiculous that PetroSaudi owner the future governor of Riyadh, Prince Turki, the seventh blood son of the then King Abdullah - the custodian of the two holy mosques and the absolute ruler of Saudi Arabia - would want to pakat with Jho Low to cheat Malaysia of USD1 billion.

After all, Saudi Arabia is the world's largest oil producer and exporter with a GDP more than twice the size of Malaysia.and FOREX reserves of USD280 billion.

Saudi Arabia and their Royal family are not hard-up for money at all.

Sometimes I am amazed how Sarawak Report and the opposition can get so many people to believe the absolutely ridiculous story that the son of the absolute king of wealthy Saudi Arabia would collude with a foreign fat Malaysian Chinese man to cheat Malaysia of USD1.83 billion.

And true enough - 1MDB got back every single ringgit they invested and made as much as USD500 million (RM1.8b) from this joint venture in three short years - a fact that has been audited by TWO separate international audit firms KPMG and Deloitte over 4 years and shall be confirmed once again by our Auditor-General in their special audit - with full documentation and proof too.

Was 1MDB's funds in PetroSaudi ever at risk? Think carefully. Do you think the Absolute Monarch of oil-rich Saudi Arabia would like world-wide headlines to scream:

Was 1MDB's funds in PetroSaudi ever at risk? Think carefully. Do you think the Absolute Monarch of oil-rich Saudi Arabia would like world-wide headlines to scream:

"Blood son of Saudi Arabia King Abdullah cheats Malaysia government out of USD1 billion" ?

I don't think so.

Much of these USD2.32b were redeemed and spent elsewhere by 1MDB and the remaining USD933m landed up as the infamous BSI "units not cash" in Singapore - but still guaranteed by Abu Dhabi. These units have since been earmarked for the USD4.5b asset-debt swap with Abu Dhabi and USD1 billion was already paid upfront by them to 1MDB. Sarawak Report, Tony Pua fan-boys, Tun M supporters and the many critics of 1MDB and PetroSaudi frequently point out that 49% of PetroSaudi Oil Services Limited is not worth USD2.3b and questioned why a "dodgy shelf company" can be worth so much. In fact, during questioning in the PAC, one of the top auditing company in the world, Deloitte stands by their audit and valuation.

“Deloitte told us that they have seen the bank statements pertaining to the RM13.4bil of assets in BSI Bank. They can verify the value of the assets in question as they did a test on whether the assets were at fair value at that point in time for FY14,” PAC chairman Datuk Nur Jazlan said at a press conference after the inquiry.

“As of March 31, 2014, Deloitte said they had gotten independent valuation of these assets of RM13.4bil and the valuations tallied. Deloitte had not done any work for FY15, as they only did it up to March 31, 2014,” PAC member Tony Pua, who was also present, said.The critics have said that PetroSaudi Oil Services Ltd has no assets and hence the Bridge Capital funds are also worthless and do not exist. In May 2010, an oil platform in Venezuela sank. And the Venezuela Govt then announced that it has leased a USD2.5 billion Songa Saturno offshore platform from the company called PetroSaudi Oil Services Limited Bloomberg reported this and said Petrosaudi’s Songa Saturno platform, which will be used to develop offshore natural-gas resources, joins the Petrosaudi Discover rig in replacing the Aban Pearl platform that sank near Trinidad and Tobago in May of that year.

It is amazing that Bloomberg and the Venezuela govt had the foresight in the year 2010 to become UMNO-BN cronys to help lie to the world to cover up the fact that PetroSaudi Oil Services Ltd is worthless. Not only has the company got offshore platform and drillships, it is clear they have long-term contracts - and hence the value of the company could certainly be in the billions - certainly not shelf company or zero. They probably made up the news and the expensive rigs and contracts do not actually exist and any images of them were probably photo shop edit.

To summarize: The Joint venture was with an important Prince who was governor of Saudi's capital city and son of the absolute monarch of oil-rich Saudi Arabia.

The entire amount of 1MDB's investment of USD1.83b was returned with USD300m in dividends plus USD2.32 billion of fund units that are fully guaranteed by the Abu Dhabi Government - and the valuation of these units are confirmed multiple times by one of the largest auditor company in the world, Deloitte. .

These units have been redeemed and the money used with Abu Dhabi Govt paying USD1 billion cash for the remaining units held in BSI Singapore.

So, where is it in the chain shows that money is lost or stolen?.

Can any 1MDB critic care to explain this? Tony or Tun M, perhaps?

Mr Lim, the piece contained a whole load of info. The 1MDB saga has been going on for more than a year. I am curious why was this piece published only now. Had it been done early, controversies and tales spinning could have been avoided

ReplyDelete